Next Action selling: Your simple guide to activity-based selling

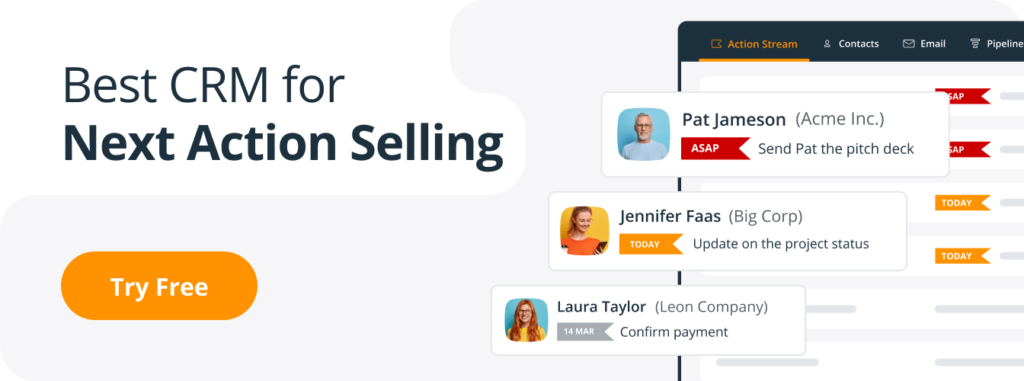

Developed exclusively for OnePageCRM, the Next Action sales methodology is inspired by David Allen’s GTD, or Getting Things Done, productivity principles.

The beauty of the Next Action sales method is in its simplicity.

It does not require hours of training, you don’t have to read multiple productivity books to understand the concept.

It really is that simple.

What are Next Actions in selling?

In its simplest form, a Next Action is a sales task that needs to be done next in order to keep your deal moving.

For example, if you’re trying to win over a new client, there’s a series of steps (sales actions) that you usually take. These steps are your Next Actions.

Examples of Next Actions (for sales and business)

Here are a few examples of Next Actions:

- Follow up with an email

- Set up a check-in call

- Send a sales pitch deck

- Agree on the quote

- Ask for a testimonial

- Schedule an in-person coffee meeting

And so on.

These are usually sales actions.

They are steps required to move your sales deal from one stage to another.

By writing sales actions down and visually organizing them, salespeople can clearly see their sales process, improve it, and move from one step to another at a steady pace.

Why Next Action selling is gaining momentum?

Next Actions sales method is a powerful tool that lets you focus 100% on taking action (a.k.a. selling).

It incorporates several elements:

- a sales methodology,

- a productivity routine,

- and a time management technique.

By encouraging upfront decision-making, the Next Actions sales method ensures you never miss out on an opportunity to sell.

“The Next Action Sales once applied within any sales system will help to minimise slippage and maximise deals.”

How can Next Action selling improve sales?

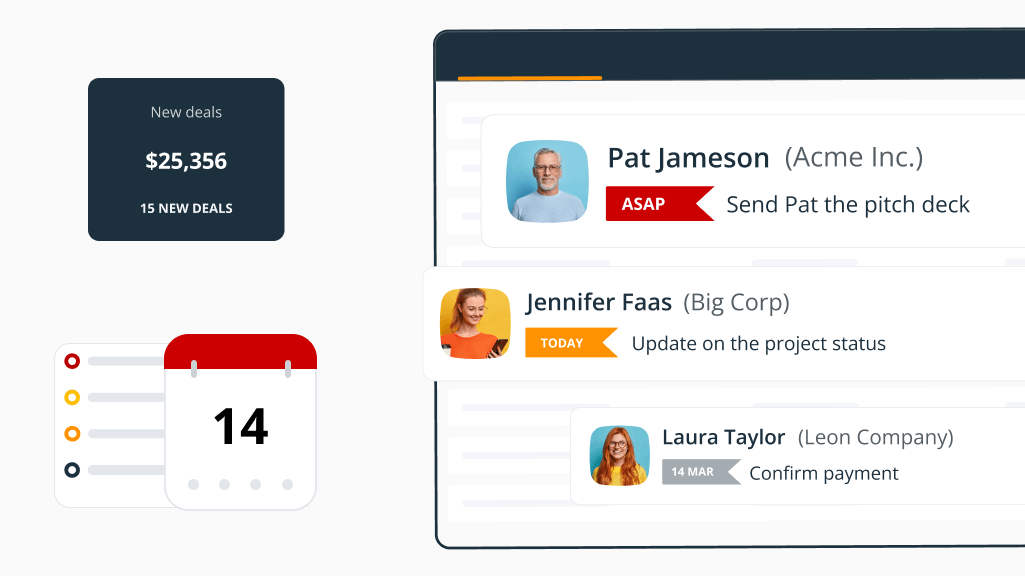

Imagine that it’s just after mid-day and among a slew of other tasks, you have to follow up on about a dozen potential clients.

With each of them, you have some previous communication. Be it an invoice with a note, a reminder, or a series of emails. There are lots of bits and pieces that you’ve been doing to build a relationship with your leads.

All of this information is—hopefully—diligently recorded in your CRM system: from meeting notes to email threads. It would have been impossible to keep track of who said what, when, and how you’re meant to follow up without a CRM system.

However, storing this information is not enough. To get new clients, you need to put this information into action.

This is where the Next Action sales method comes into play.

They can be assigned to any contact in your database and eliminate the need for an additional to-do app.

With Next Actions, every contact in your CRM is treated as a business asset.

5 benefits of the Next Action sales method

Next Action selling focuses on sales activities, which can vary across different companies and industries.

Here are the key benefits of the Next Action selling method:

- Less cognitive load. Once you complete one sales action, a new one is automatically added to your contact. You don’t need to think about what the next step is—your action-focused CRM does this for you. With the Next Actions sales method, your time investment is needed only at the very beginning: when you outline all steps. Once you have them ready, put them into the system—and revisit them only when the time is right.

- Higher productivity. By having a predefined sequence of next actions for each lead, you can significantly reduce downtime between your sales activities. It’s similar to having a personal assistant reminding you of what’s up next—only it’s built into your CRM.

- Better workflow. If implemented well, the Next Action sales method helps you maintain just the right cadence with your follow-up routine. This ensures you stay on your customer’s radar without overwhelming them with messages.

- Sharper focus. By narrowing down your focus, you can double down on making your task as impactful as possible. The Next Action sales method frees your mental resources from all what-ifs and what-next and makes it easier for you to focus only on one sales action at a time. It’s about doing one thing and doing it well before moving on to the next.

- Less stress. The number of sales tasks can feel overwhelming at times. The Next Action sales method offers you peace of mind and a clearer headspace. Implementing the Next Actions method is similar to having a roadmap for your sales process.

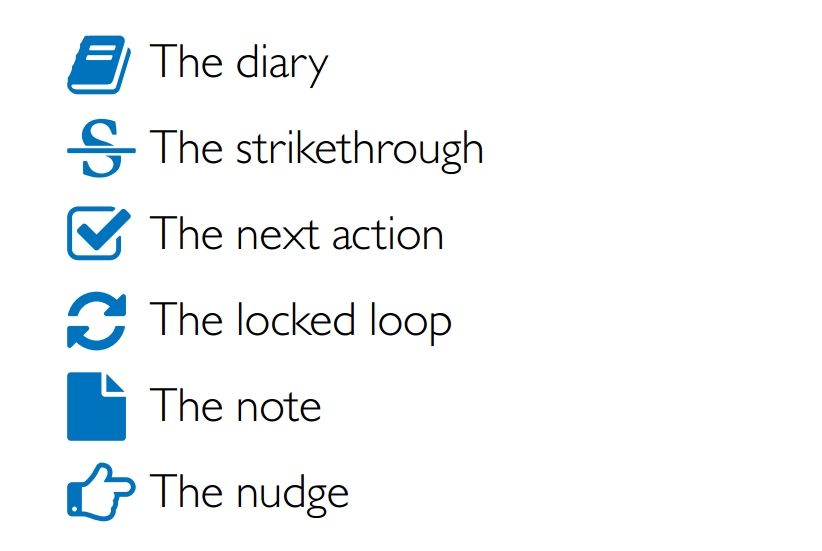

The key elements of the Next Action selling method

The Next Action selling method involves a number of elements, namely: the diary, the strikethrough, the next action, the locked-in loop, the note, and finally, the nudge.

Once you understand the role of each of these key elements, you’ll be able to implement Next Action selling in your organization too.

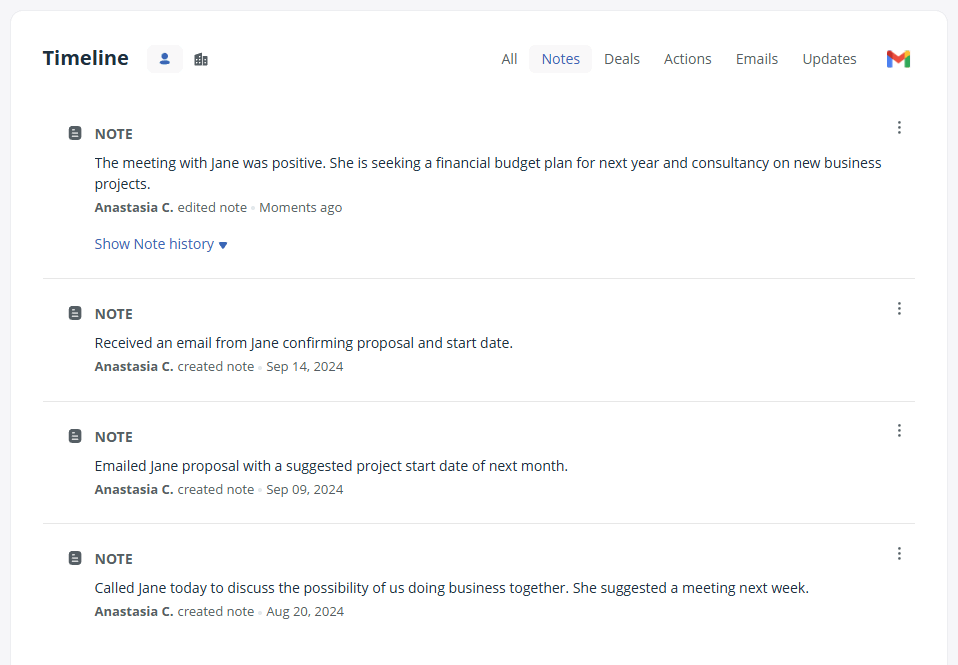

1. The Diary

First, you need to record every interaction (however seemingly insignificant) you have with your prospects and customers inside your CRM. This is what the diary is all about!

Keeping track of these interactions will help you personalize your approach and remember all details during your next meeting or call.

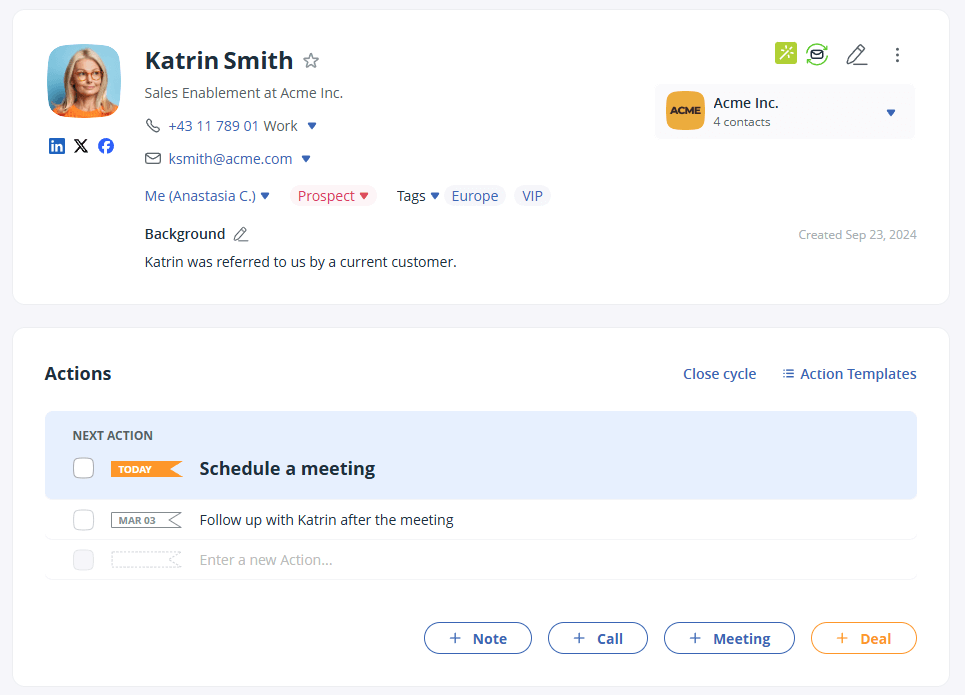

Once you record the last interaction, add a Next Action to this contact straight away.

For example, you can save a quick note with what you talked about during your last meeting—and add a reminder to follow up and confirm if they will have received your contract in 2 days.

Alternatively, if you have a new referral, add a reminder for yourself to reach out and schedule a meeting with them:

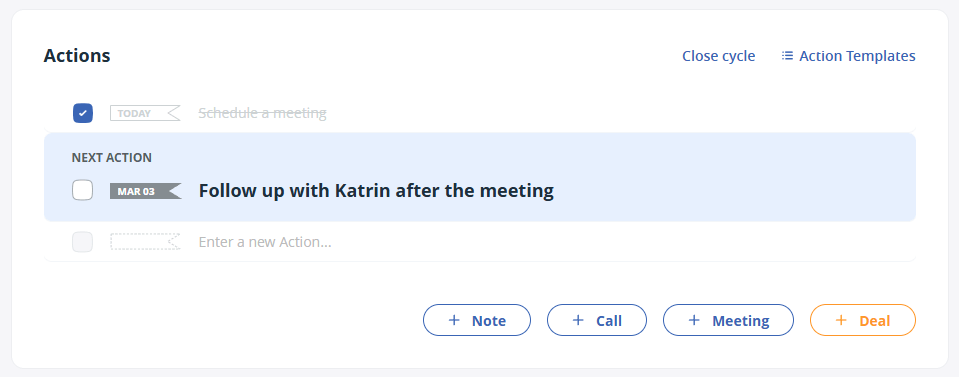

2. The Strikethrough

Once you complete your Next Action, the next element is the strikethrough.

There’s an undeniable satisfaction in crossing off items from your to-do list—and the Next Action sales method lets you do it.

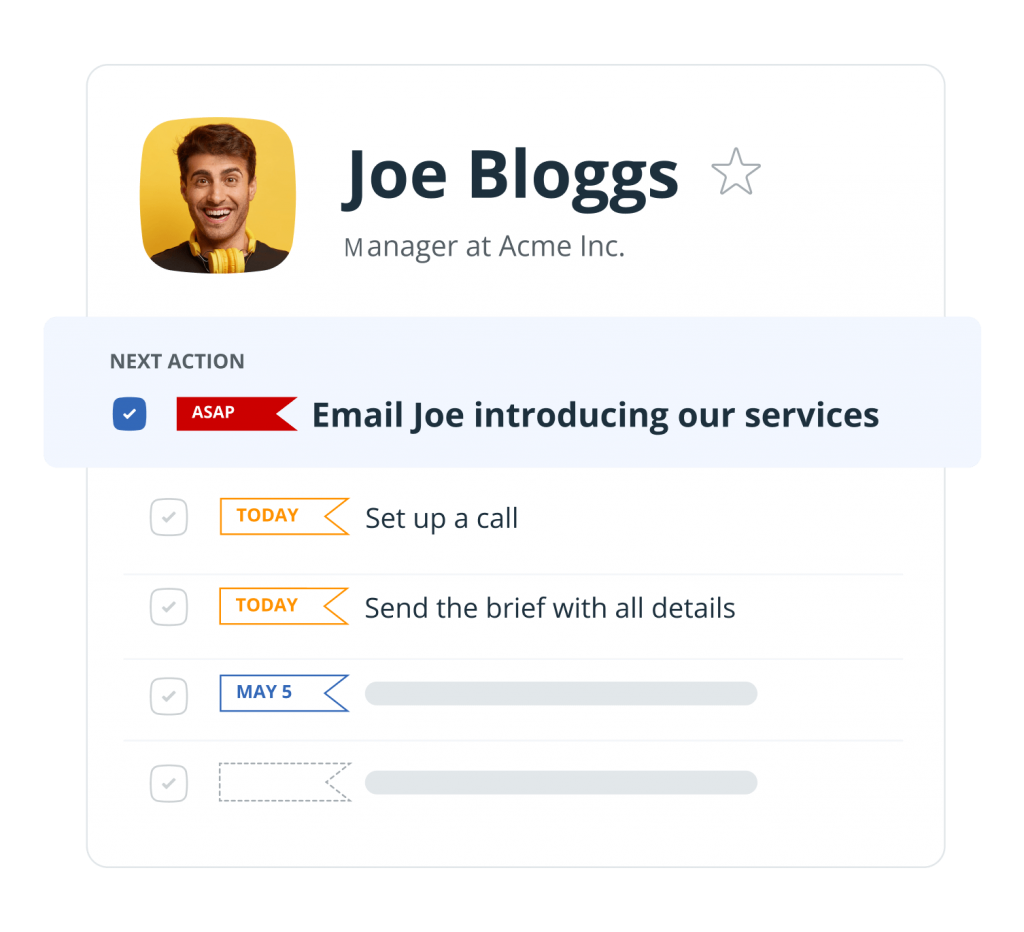

Your Next Action is your most immediate task on the list. Once you cross it out, the blue area moves down to the next most urgent task:

What’s more, once the Next Action is completed, OnePageCRM automatically asks you to set a new one (see point 3 below).

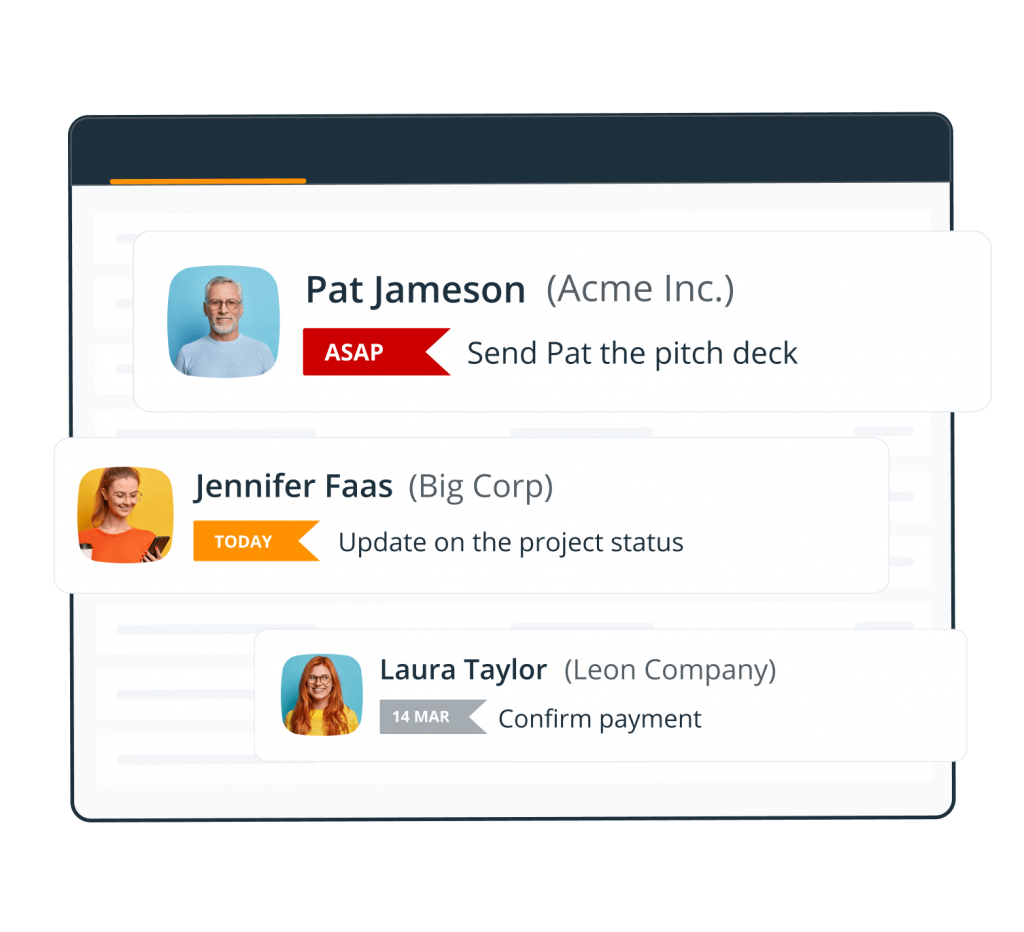

All Next Actions for the day are organized in your color-coded Action Stream. This way, you can easily move from one task to another.

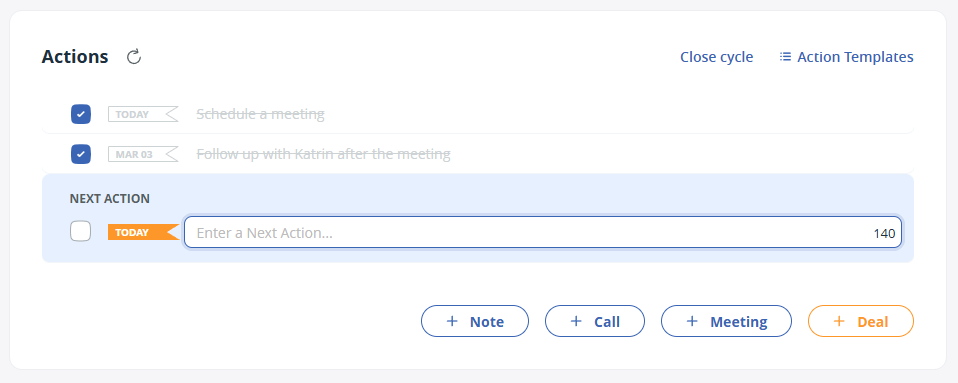

3. The Next Action

It’s important to keep a proactive approach to setting your Next Actions with a client, by deciding on the follow-up action directly after completing the last.

This is the time when you have the clearest perspective of the situation and what’s required next to close the deal. Being proactive at his stage will improve the quality of future sales actions, making them easier and more automatic to execute when the time comes.

OnePageCRM is built around the next action selling principles, so once you complete all Actions for a contact, it reminds you to think about your future steps:

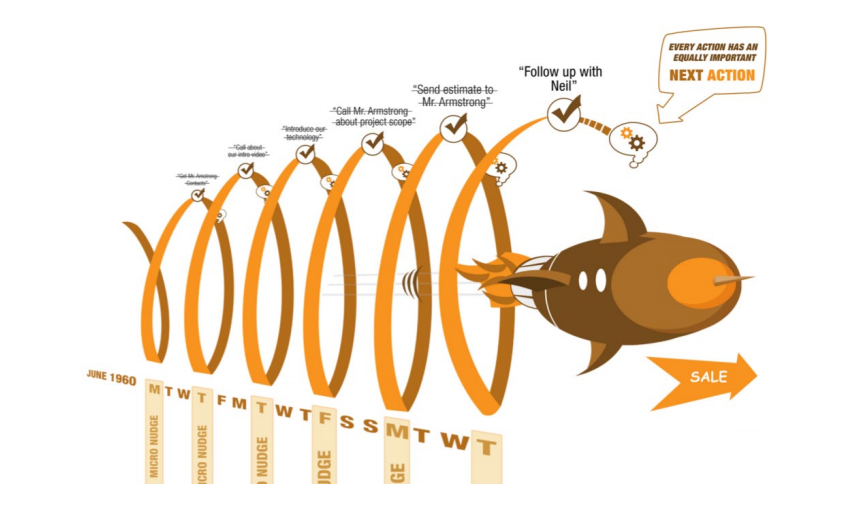

4. The Locked Loop

All your Next Actions are locked into a system, moving around in proactive cycles; disappearing from view when not relevant, and reappearing when the time is right, thus creating a locked loop of sales actions.

The sales loop is not complete until either a sale is made or the contact is put on hold (or deleted).

Remember: For every action, there is a corresponding future Next Action. See the visual representation of the locked loop below.

5. The Note

As well as dates, you also need to keep notes on your communications with people. Notes are an integral part of the next action selling principle. If you want to set the correct next actions, you need to know the history of communication (you can’t just set any next action and hope that it’ll help you close the deal).

Your notes should provide you with just enough detail to enable you to make the right move.

Notes should be linked to each customer and where necessary, each action. They might cover things like what the person said on each occasion they were contacted, what you replied and what tone the person used.

6. The Nudge

Next action selling is tightly connected with the concept of proactive sales.

In this example, a Next Action is a nudge, a gentle push in the direction of finalizing a deal with a prospective client.

The days of the aggressive approach to sales are long gone. Building strong relationships with customers is the measure of modern sales success. And relationships require consistency that can be achieved with next action selling principles.

Contrary to a notebook, OnePageCRM takes care of reminding you about upcoming sales actions. You can choose to receive email reminders with summary of your daily agenda every morning.

This is what we call a Nudge.

A nudge gives the sense of moving things forward which is so important in sales but without being too pushy. It could involve anything from being patient with a client while they make their decision, to helping them “sell” it to their colleagues/bosses.

Always set a Next Action to follow up, regardless of whether the time is now or later.

Tips for sales activities in Next Action selling

Next Action selling encourages you to follow up with a lead.

However, to benefit from its use, you must set proactive, actionable Next Actions that convert.

Here are our top tips for creating powerful Next Actions.

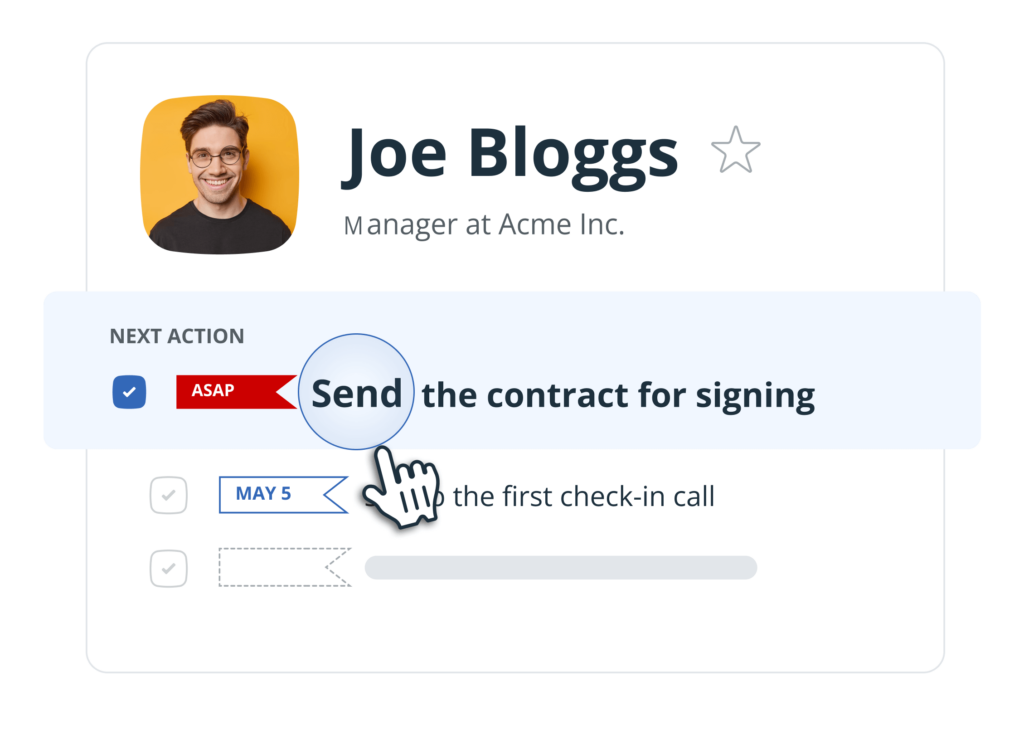

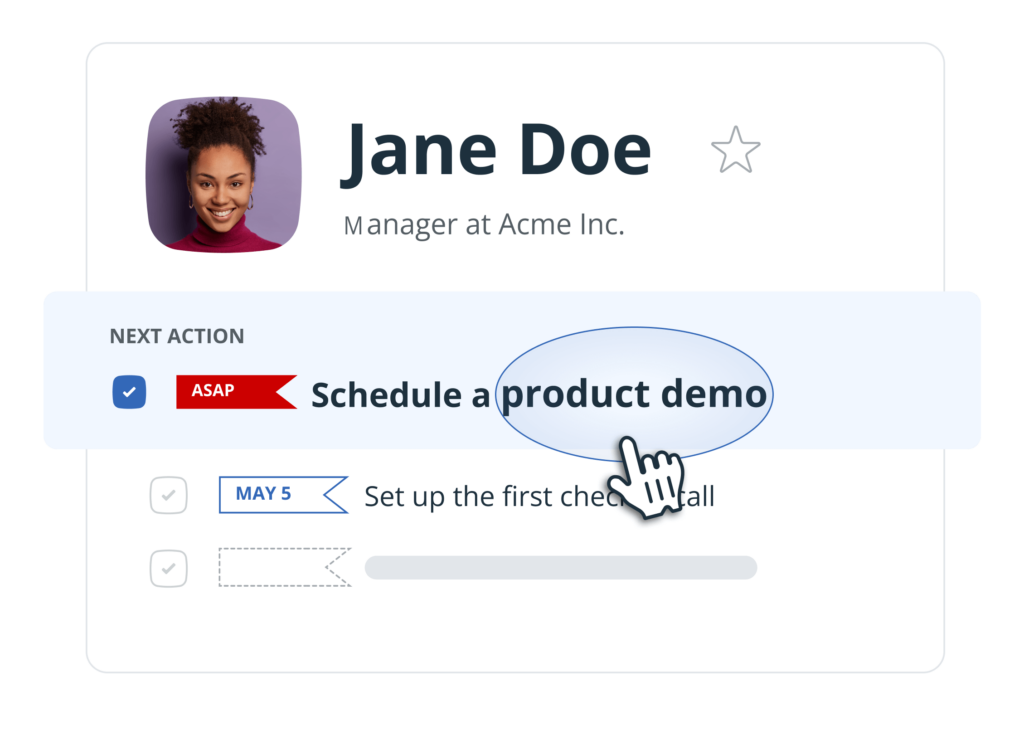

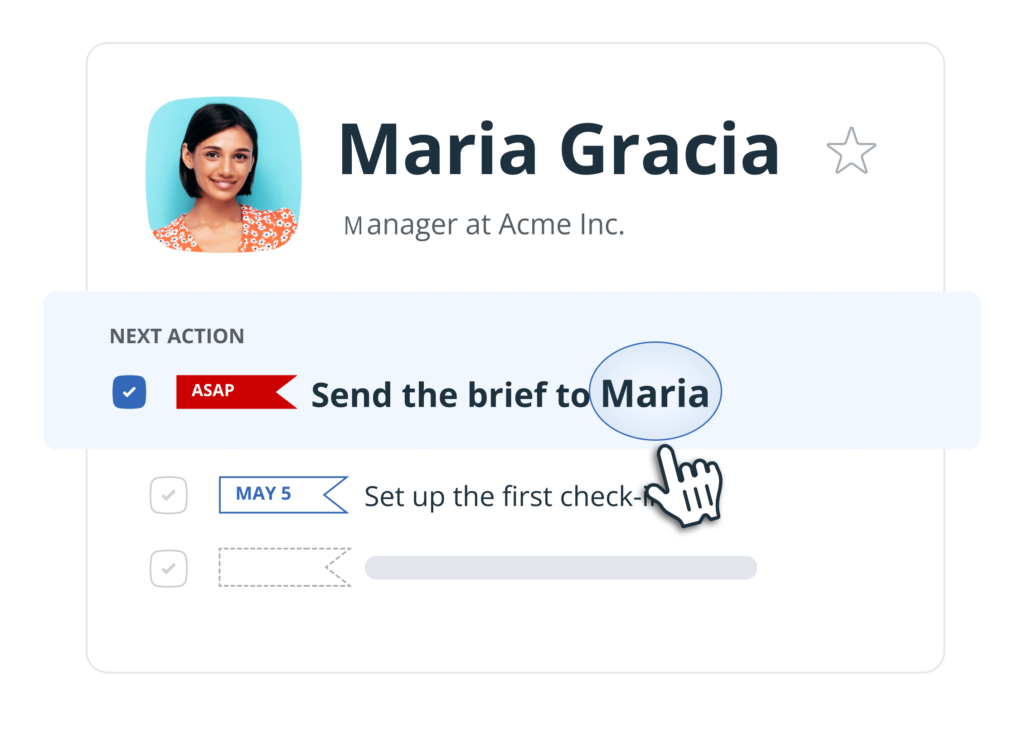

1. Use a verb when describing a sales activity

Use a verb at the start of the statement, this will trigger action, rather than procrastination. Actions should be decided upfront – so when the time arrives for ‘doing’, you’re halfway through the battle.

Examples of action verbs: call, email, meet, schedule, etc.

Action verbs are verbs that trigger the necessary action.

2. Be specific when setting a sales activity

Be specific about what needs to be done, so that you can glance at the list and get an overview, without too much investigating.

That’s why it’s important to keep it to just a few words (that’s why we have a limit of 140 characters).

To be effective, Next Actions should be constructed in very simple and direct language. Be clear about what needs to be done and for whom.

3. Use contact names for sales activities

Always use the Contact’s name. This reinforces a connection between you and your prospects and gets you ready for interaction.

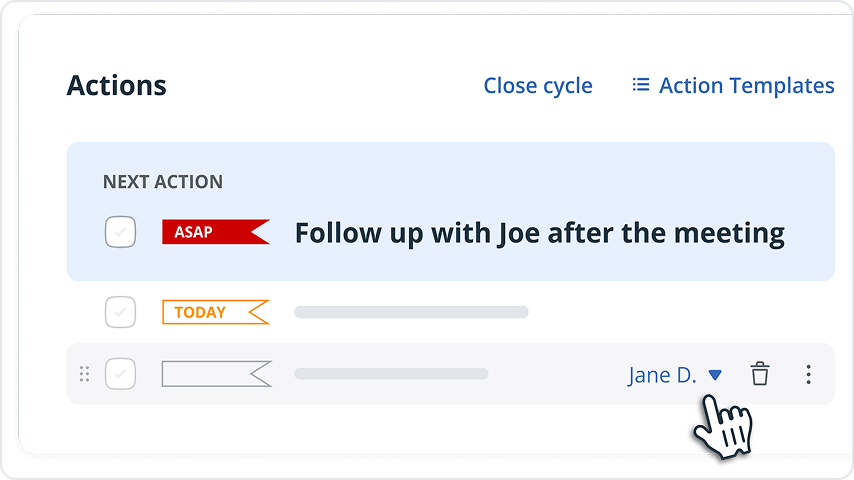

4. Assign activities to different sales reps

Don’t overlook the importance of assigning sales activities to different sales reps.

If you have a few sales reps on the team, some of them might excel in negotiation, while others have a knack for cold calls.

If one member of your team works wonders in breaking the ice, assign all outreach activities to them.

On the other hand, if you have a sales rep who excels in navigating complex conversations, bring them in at the final stages of a deal.

Next action selling is a team sport!

How to implement a Next Action sales method

Implementing a Next Action sales method can transform the way you do sales. It’s especially important for small businesses that often don’t have formalized sales processes and need an agile system instead.

Implementing Next Action selling in your organization isn’t an overnight success story. It might take time because it comes with a mindset shift.

Its implementation requires deliberate changes and a certain level of tolerance towards a trial-and-error approach. By focusing on what’s next, rather than getting overwhelmed by the end goal, you’ll likely notice how healthier your sales pipeline is.

Here’s how you can set up a Next Action sales method in a few manageable steps:

Step 1. Identify your main sales activities

What is the sequence of steps needed to move a prospect closer to a sale?

The answer will vary from one business to another.

For example, for some companies, cold calls might be an integral part of their sales process. But maybe for you, regular follow-up emails are enough.

In this first step, take some time to reflect on your sales process and try to distill it into specific actions/steps/activities.

Step 2. Simplify and prioritize

Once you’ve identified your top sales activities, break them down into smaller, manageable tasks (your Next Actions).

Every big activity should be dissected into bite-sized sales actions that can be easily tackled. Make sure to follow the guidelines above (use verbs, keep them succinct, and assign them to relevant team members).

If during the first step, your main task was to get a bird-view of your sales process, in step 2, you need to create an action plan, your to-do list, by organizing all activities into doable steps.

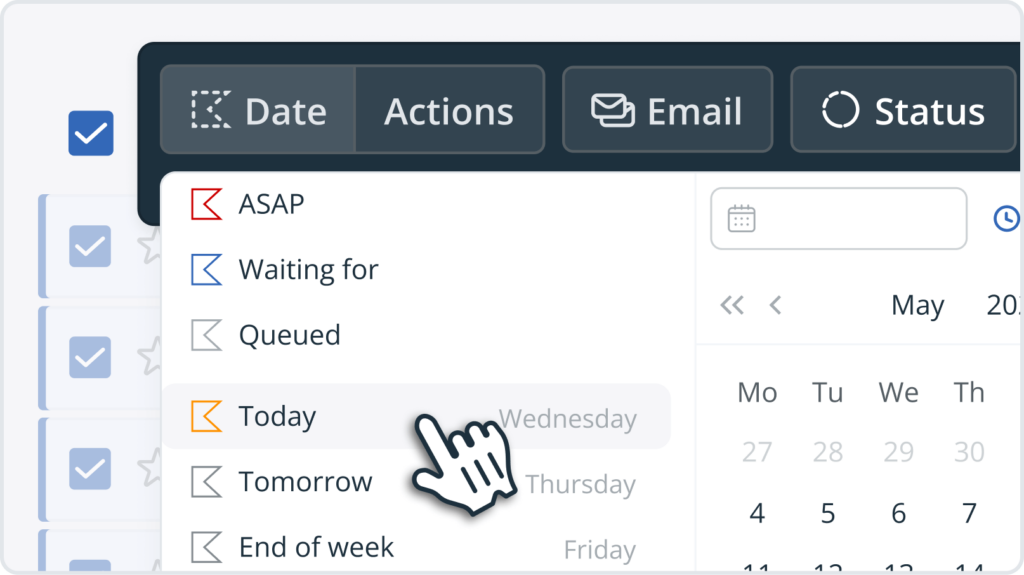

Step 3. Set clear deadlines

Every sales action should have a specific deadline.

This creates a sense of urgency and helps prevent tasks from being perpetually pushed to the back burner. Next action selling requires an uninterrupted flow of sales actions, which can be achieved by having clear deadlines.

When assigning tasks, be realistic about the time required to complete them. It’s a good idea to always accommodate for unforeseen delays. This will help reduce the unnecessary build-up of stress.

Step 4. Use an action-focused CRM

Does your sales team have the tools to execute these Next Actions efficiently? If you’re leveraging a CRM, make sure it supports the Next Action selling.

Next Action selling method works very well with an action-focused CRM.

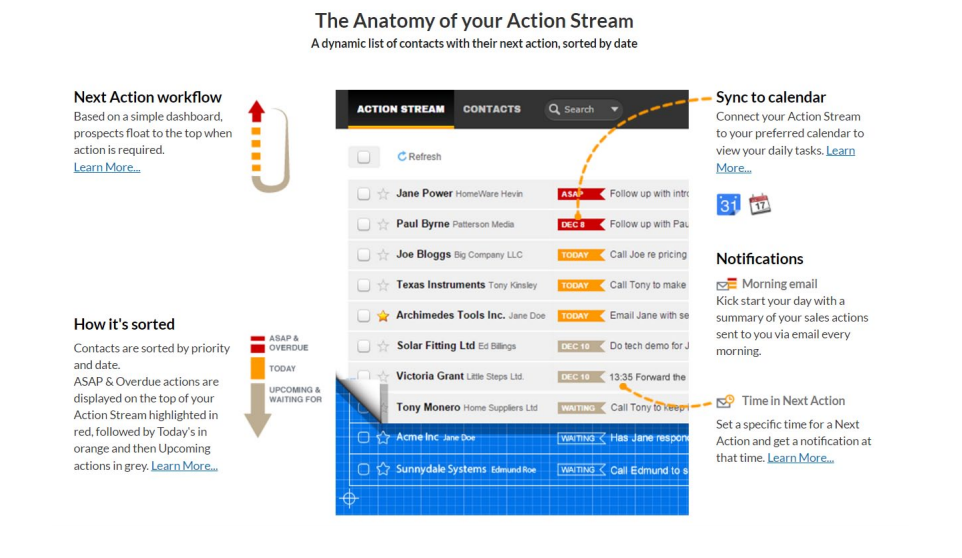

It’s a simple CRM system designed to keep the focus on actionable sales steps. Every contact in the system can be assigned a time-sensitive Next Action. Besides, these CRMs sort all contacts by the urgency of the tasks and reminders set next to them.

Step 5. Review and adjust your Next Actions regularly

Sales are dynamic. So should your approach be.

Regularly review your sales activities and the associated Next Actions.

What is working? What can be improved? What needs adjustments?

This helps to keep your sales strategy on track and your team aligned with set goals.

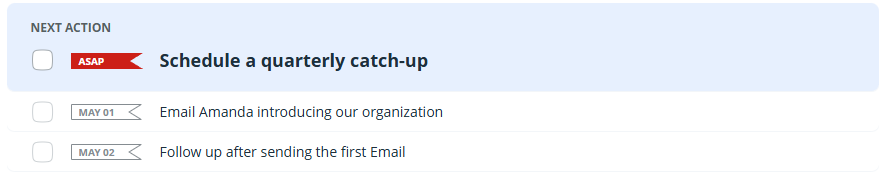

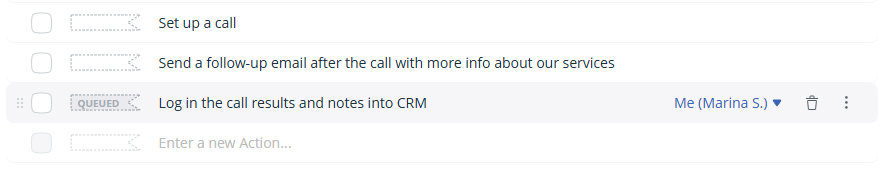

Step 6. Queue Actions

In the next action selling method, you can schedule a series of actions, one after another.

In other words, you can queue them.

Keep your most urgent task as your immediate Next Action. Once it’s complete, OnePageCRM will automatically move the following Action to the top place.

Queued Actions with dates help to manage multiple tasks and follow-ups associated with a single contact.

If you are unsure of the due date, you can also queue actions without dates.

How Next Actions work in OnePageCRM

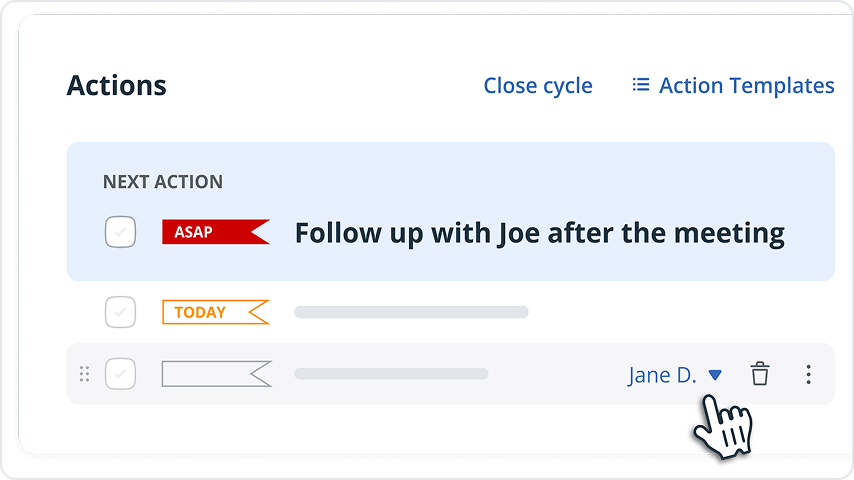

In OnePageCRM, Actions are very dynamic. Not only can you organize them in an Action Stream, but you can easily work with them on Contact Pages too.

A Next Action is the most urgent task on your list.

That’s why it’s always highlighted in blue—it’s very easy to spot right away, so that you instantly see what to focus on next:

If there are several Actions scheduled on the same day, you can drag and drop them to change their priority.

For example, if you have a meeting and a follow-up email scheduled for one day, you might want to have that meeting first and follow up later.

And if you think you are not the best person to send an email, drag and drop this task to someone else.

This is not the only way to assign tasks to team members.

Hover over an Action, click on the drop-down, and pick another user:

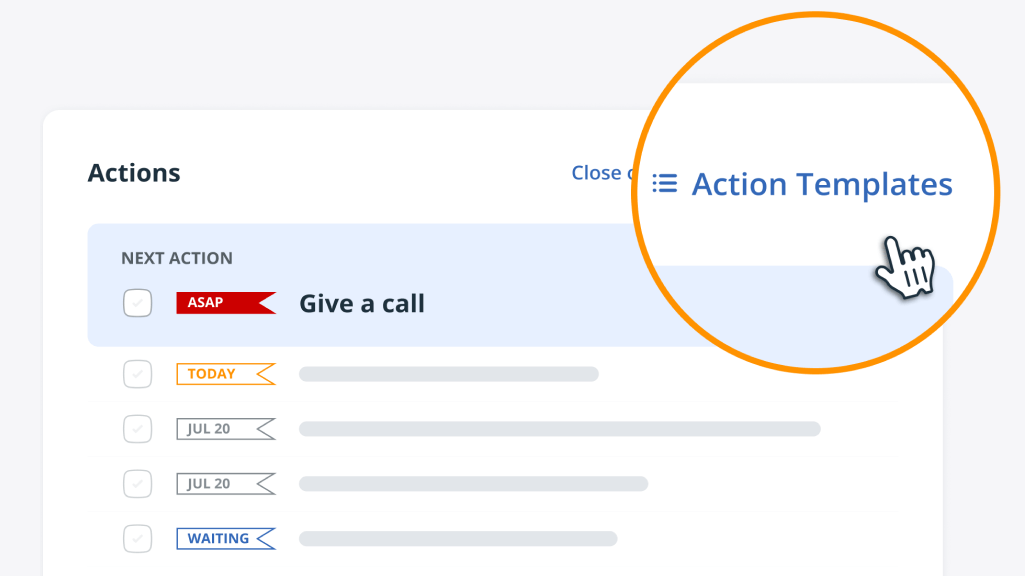

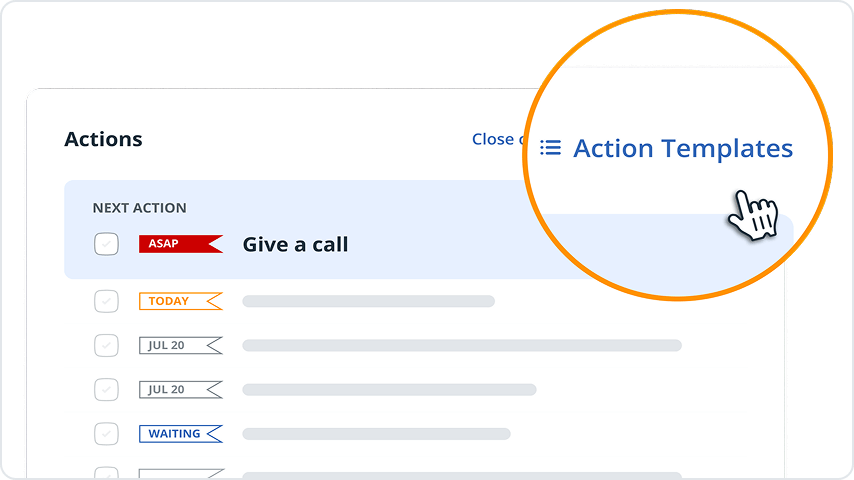

For those of you, who prefer standardized processes, make sure to check out Action Templates (previously known as Saved Actions).

This is a pre-saved list of sales activities in a step-by-step format that you can add to contacts in one click:

It’s especially handy for those who have repeatable workflows and want to add them to contacts instantly.

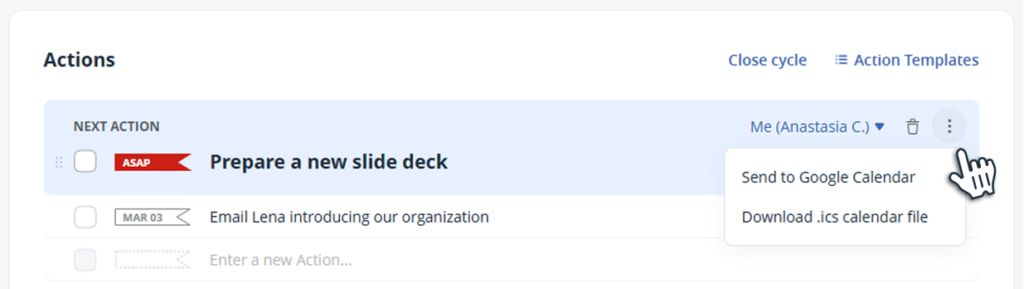

Visualizing your Actions is also easy with OnePageCRM.

OnePageCRM has an in-app calendar feature and also an integration with your preferred calendar apps.

But if you want to keep only some Actions on your Google, Outlook, Apple, and other calendars, add them individually:

Staying on top of all your follow-up reminders requires regular clean-ups. To keep your workload manageable, you need to remain flexible and sometimes even re-prioritize on the go.

You can do this quick reprioritization with the Bulk Updates bar.

To update Action dates for different contacts at once, go to your Action Stream and select all the contacts you need. Click on the Reschedule button to easily change dates or snooze overdue actions in one click:

Next Action selling is your systematic approach to sales

So, there it is; the systematic approach to sales based on setting Next Actions, performing them in a timely and well-informed manner, moving the situation forward with a series of nudges, until hopefully agreeing a deal.

Keep administration to a minimum and selling at a maximum with the Next Action selling method.

It takes an extra one or two seconds to write the sales action properly – but could mean the difference between winning and losing a sale.