How small businesses keep on top of their invoicing has changed radically over the past few years. More and more businesses are switching to cloud accounting software to make the most of the benefits of online accounting and to help streamline their core processes.

As a small business owner, you might be a born entrepreneur, but you’re less likely to be a born accountant. So it’s possible that you’ll find bookkeeping a tedious distraction, especially when your focus lies with building your brand and growing your business.

Accounting apps like QuickBooks, Xero, and Sage can help make your entire operation run more smoothly. And that gives you more time to do what you love best—growing your business!

What is cloud accounting?

Cloud accounting is used synonymously with online accounting and web-based accounting.

5 benefits of cloud accounting

Here are our top 5 reasons why running a business is more efficient with cloud accounting software:

1. Easy access to financial data anywhere and anytime

Using a cloud-based invoicing app gives you easy access to your figures anytime, anywhere. It’s hosted remotely which means you don’t need to worry about any time-consuming downloads and updates.

To keep up with business on the go, you can even access your invoices using a mobile app. This gives you added flexibility and peace of mind, meaning you don’t need to be sitting in your office to check your cash flow or access your accounts.

2. Up-to-date view of the business

When your data lives in the cloud you’ve always got a completely up-to-date view of your current financial situation. And that allows you to make better-informed decisions about the financial future of your business.

Using traditional accounting methods, you’d have to scroll through pages and pages of out-of-date management reports. Now you’re looking at your company’s finances in real-time—and that’s a pretty amazing benefit when you’re a fast-growing company.

3. Better relationship with your accountant

As a business owner, you’ll still need to regularly collaborate with your accountant to make sure your financials are up to date, particularly when it comes to filing your end-of-year tax returns to the revenue.

As a result, you may spend a lot of time with your accountant—which can be both costly and time-consuming. But with a proper cloud accounting app, you and your business advisers will always be looking at the same online ledger.

That means you’ll get a much deeper and more valuable client/accountant experience by talking about your finances in real-time conversations. Your accountant goes from being an expensive compliance overhead to being an integral part of your management team.

4. Paperless and decluttered office

Keeping your paperwork in order can be a challenge. Expenses, receipts, and invoices all mount up—and working your way through them takes time.

With a cloud accounting app, you can import your paperwork straight into your accounting software, moving your data straight into the digital realm and allowing you to see your numbers at a glance. It helps minimize the risk of manual error and results in a faster and far more efficient method for keeping on top of your finances.

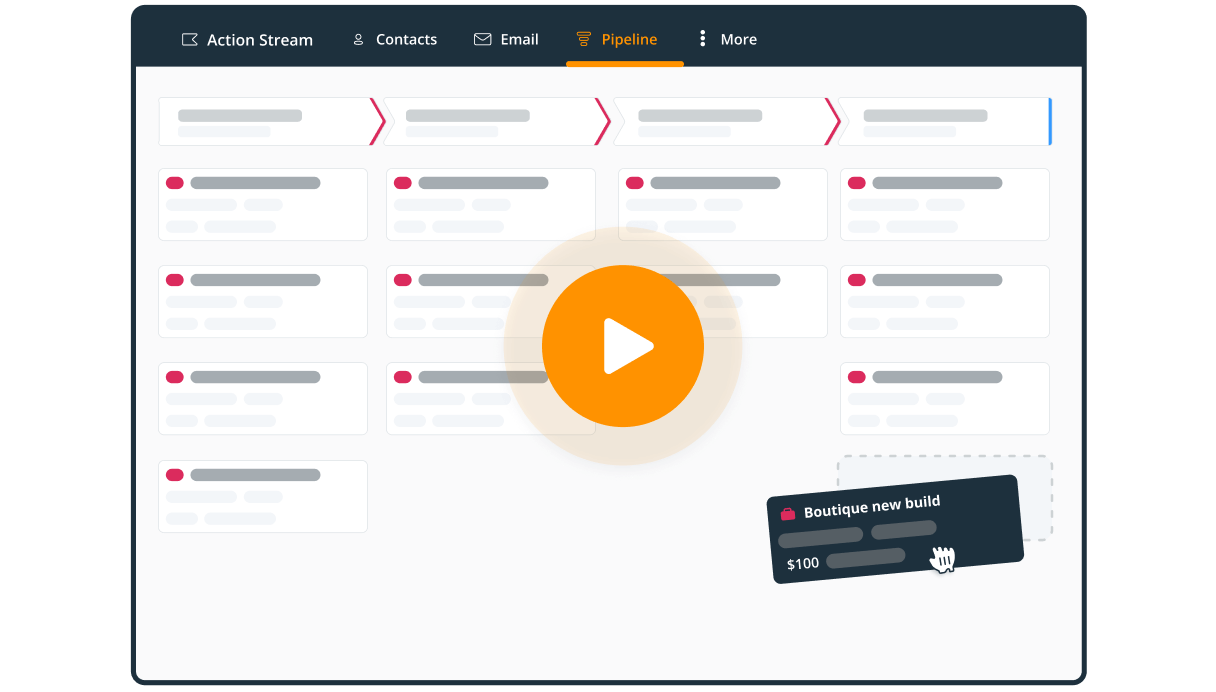

5. One ecosystem for your business

Finding one system that delivers all your business needs can be difficult. That’s why its vital to integrate with other online apps which help form part of an entire ecosystem.

Using a cloud accounting app and a CRM side by side can join the dots—from generating and nurturing leads to ultimately creating revenue. Depending on your needs, you can create a workflow that works for your business and improves the efficiency of regular tasks such as invoicing, reporting, payroll, etc. Cloud-based applications play a huge part in making that possible.

Make the move to cloud accounting

So, it’s clear that a revolution in accounting software has taken place: desktop-based software is dead and the cloud is where it’s all happening and fast!

If you’re an ambitious, tech-savvy, 21st-century business, cloud accounting is the unrivaled option for keeping on top of your finances.

Cloud Based is the best accounting tool for small business tool for growth and to gain success. Thanks for this!

Thanks for your comment Gwyn 😀

I am happy that there are a lot of tools now that helps business owners like me in accounting. I am also using Zero . I can say that I find the best accounting software. Thanks for sharing this article. I really enjoy reading this.

Hi, thanks for your comment. Great to hear Zero and other software tools are aiding you with your business. Evelyn

“Thanks Steve for sharing the informative article. Many businesses prefer the flexibility and simplicity of cloud computing to conventional local hosting and on-premise software when it comes to data storage, processing, and collaboration.

Your reliance on paper can be significantly reduced with an online accounting solution. Direct emailing of invoices to customers reduces printing and postal expenses and expedites the payment process. Incoming bills and receipts can be scanned and preserved alongside the related transactions in your accounting software.”

We’re glad you like this blog post, Ian!